Why VIRA?

Steady income in retirement is the most significant issue for older Americans who are not affluent and lack a legacy defined benefit pension plan. According to the 2020 TransAmerica Employee Retirement Survey, the most frequently cited retirement fears of workers (40% and 34%, respectively) were “outliving my savings/investments” and “declining health that requires long-term care.”

A longer life expectancy forces individuals to invest a larger share of their income to retain a high quality of life and cover healthcare and long-term care (LTC) costs in old age. These findings support a strong demand for financial products that provide guaranteed income in retirement and protection of accumulated wealth from LTC costs.

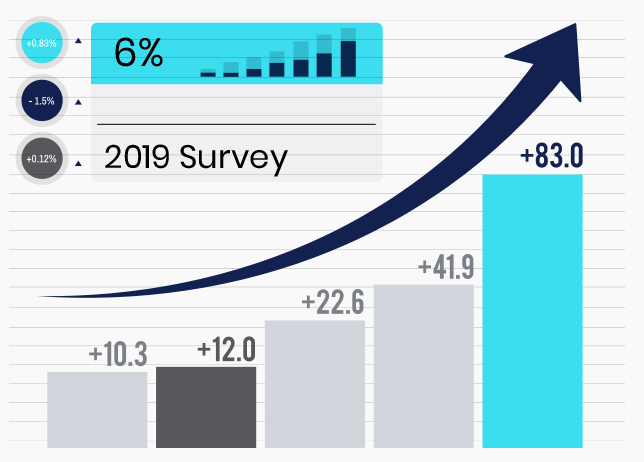

However, extensive research and various surveys reveal that traditional life annuities remain unpopular among retirees. For example, the 2019 survey conducted by the Insured Retirement Institute reported that only 6% of baby boomers plan to purchase an annuity, although 8 in 10 believe that income sources must be guaranteed for life.

Several studies and surveys have shed light on why retirees do not like traditional life annuities. Commonly cited reasons include the forced surrender of control over their savings, a lack of capital appreciation potential, and a lack of opportunity to pass the money invested in annuities to heirs.

Many mutual fund companies offer post-retirement funds, such as retirement income and managed payout funds, as an alternative to life annuities. However, post-retirement funds account for only $757 billion in assets out of the $1.7 trillion in target-date funds. The problem with post-retirement funds is that their income payouts are neither guaranteed nor regular.

Wiener (2014) defines LTC as “a range of services and supports to meet personal care needs.” According to the Congressional Budget Office, most LTC comprises not medical care but assistance with the basic personal tasks of daily life, such as eating, dressing, bathing, transferring, and using the bathroom. The U.S. Department of Health and Human Services (HHS) predicts 70% of those turning 65 will need some LTC.

Unfortunately, according to the American Association for LTC Insurance, though the population of people aged 55 and older is 93 million, only 8 million Americans currently have LTC insurance policies. Part of this is that LTC insurance is unaffordable for most retirees and inaccessible for those with preexisting conditions.

The American Association for LTC Insurance estimates that the annual LTC insurance premium for a couple aged 55 is as much as $3,725 for $162,000 of coverage, each with a 3% inflation option.

LTC without insurance coverage is expensive, and Medicare and most private health insurance plans do not cover LTC costs. In 2021, the U.S. Department of HHS estimated monthly national median prices for home health aides, assisted living, and nursing home living (with a semi-private room option) were $5,148, $4,500, and $7,908, respectively.

The research and survey results discussed above suggest a need for a new retirement financial product that remedies the drawbacks of traditional life annuities and the unaffordability and inaccessibility of LTC insurance.

Login

Login