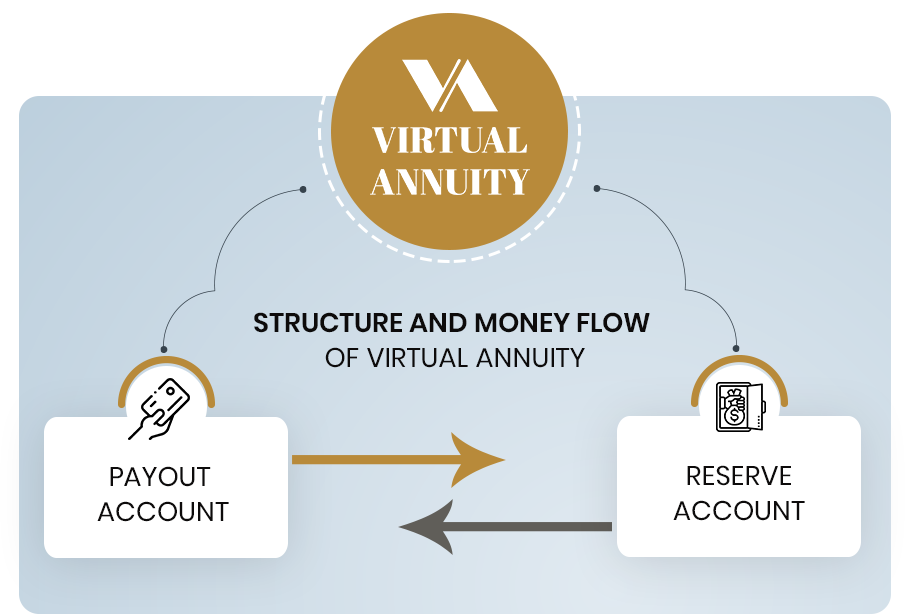

Structure of VIRA

VIRA comprises two sub-accounts: Payout and Reserve Account. The Payout Account is the primary one from which a periodic income payout is made to VIRA holders. VIRA holders themselves may select an annual payout rate between 0 and 6% of the original money deposited with the Payout Account as well as the frequency of the payout, both of which they can change at any time. The dollar amount of the annual payout may be adjusted by the cost of living.

The Reserve Account is the secondary one, the balance of which VIRA holders may elect to convert into an SPIA and/or cover expenses related to LTC (long-term care) or critical illness. When a retiree or near-retiree age 65 or younger deposits his/her saving with VIRA, 90% is placed in the Payout Account and the remainder in the Reserve Account.

For a retiree age 66 or older, the deposit rate with the Payout Account is reduced by 1% times his/her age in excess of 65. In addition, two percent of the COLA(cost of living-adjusted) value of the original money deposited is transferred from the Payout Account into the Reserve Account every year.

VIRA incorporates several protective measures against the risk of ruin, and for LTC or critical illness. If VIRA happens to miss the scheduled payouts due to depletion of the balance in the Payout Account, VIRA holders have the option to convert all or a fraction of the balance in the Reserve Account into an SPIA. [The SPIA will be administered by a third-party life insurance company in partnership with VIRA]. This means that VIRA holders are, in effect, guaranteed a minimum lifetime income stream. Alternatively, VIRA holders may instead transfer up to 90% – max(age – 65, 0)% of the balance in the Reserve Account into the Payout Account. The third option is to cancel the VIRA contract outright and withdraw the entire balance in the Reserve Account.

If a VIRA holder needs money to cover LTC or critical illness-related expenses, he/she may be allowed to withdraw up to half the balance in the Reserve Account. If necessary, VIRA may arrange a secured loan on a long-term basis from fellow VIRA holders on the borrower’s Payout Account balance and/or estate. The borrower is required to make a monthly payment of one-twelfth of 1% of the COLA value of the original money deposited with VIRA until the principal plus interest is paid back. For borrowers, the amount of money transferred annually from the Payout Account to the Reserve Account is reduced from 2% to 1%. From the investment management perspective, the loan made to VIRA holders would be part of the VIRA asset portfolio in the fixed-income securities class. The following diagram exhibits the structure and money flow of VIRA.

Additional Built-in Features

The following are additional built-in features of VIRA:

- VIRA holders may cancel the contract and withdraw the entire balance in both the Payout and Reserve Account at any time without restrictions or charges.

- VIRA holders may withdraw a fraction of the balance in the Payout Account at any time in the same manner they do with a regular brokerage account. However, VIRA holders may not be allowed to tap into the balance in the Reserve Account for purposes other than covering expenses related to LTC or critical illness.

- VIRA holders have the option to convert up to half the balance of the Reserve Account into an SPIA at any time.

- The VIRA holders not in retirement may defer the automatic payout service by electing a zero payout rate initially and requesting it later. For those VIRA holders, the initial and subsequent annual transfer of the money from the Payout Account to the Reserve Account will be suspended until they enter the retirement phase.

- If prospective VIRA holders open a VIRA IRA, VIRA provides the payout service in compliance with RMDs (Required Minimum Distributions). If the RMD is greater than the payout amount selected by VIRA holders, VIRA opens a Roth IRA or an investment account on behalf of VIRA holders and deposits the excess amount of the RMD into that newly opened account.

Login

Login